Nvidia Beats Earnings and Revenue Expectations as Data Center Sales Surge 73%

Nvidia crushed Wall Street expectations in its latest earnings report, posting a 69% revenue jump and a 73% surge in data center sales—solidifying its role as a driving force behind the global AI boom.

(WE) — Nvidia Corporation has once again shown why it leads the artificial intelligence (AI) revolution. On May 28, 2025, the Silicon Valley chipmaker posted first-quarter fiscal 2026 results that blew past Wall Street expectations. The surge came from explosive growth in its data center business, cementing Nvidia’s dominance in AI infrastructure.

The earnings came after market close and triggered a 6% rise in Nvidia stock (NASDAQ: NVDA) during after-hours trading. Shares now sit less than 5% below their January 2025 record and have reached a four-month high. Investors welcomed Nvidia’s strong performance and its bullish guidance.

Nvidia reported adjusted earnings per share (EPS) of $0.96, beating analysts’ estimate of $0.93, according to LSEG. Revenue hit $44.06 billion, topping the expected $43.31 billion. That marks a 69% year-over-year increase and a 12% jump from the previous quarter. Net income climbed to $18.8 billion, or $0.76 per share, up from $14.9 billion and $0.60 per share last year—a 26% gain.

The key growth driver was Nvidia’s data center business. It brought in $39.1 billion, up 73% year-over-year, and made up 88% of total revenue. Demand for AI chips and networking components that power large language models like ChatGPT has fueled this expansion.

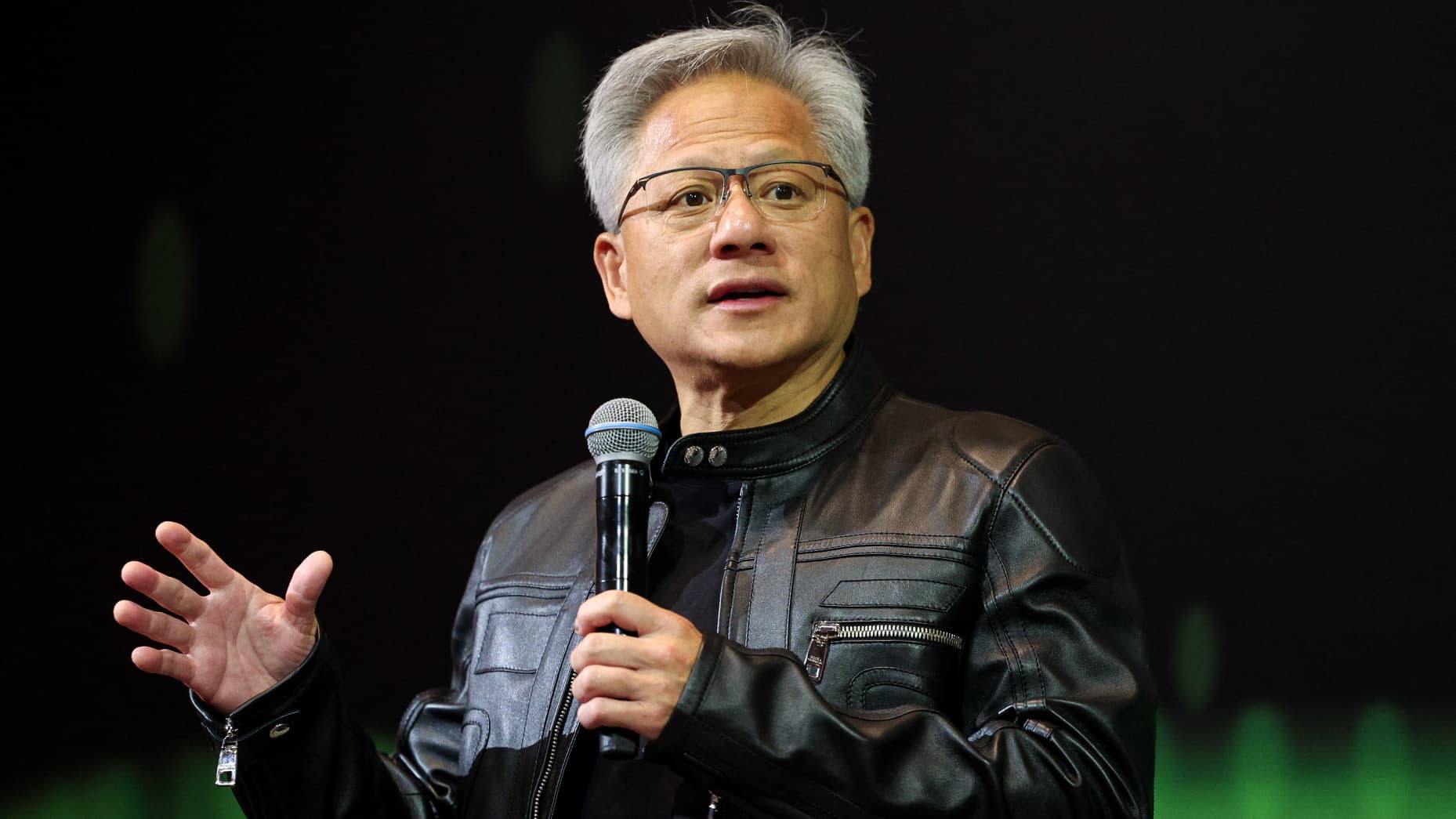

CEO Jensen Huang highlighted soaring AI adoption during the earnings call. “Global demand for Nvidia’s AI infrastructure is incredibly strong,” he said. “AI inference token generation has surged tenfold in one year. As AI agents become mainstream, demand for AI computing will accelerate.”

Still, Nvidia faces some challenges. The U.S. government tightened export rules on AI chips to China during the quarter. Nvidia’s H20 processors now require a license for export, leading to a $4.5 billion charge for excess inventory and obligations. The company estimates it missed out on $2.5 billion in sales due to the ban.

“Our H20 export ban ended our Hopper data center business in China,” Huang stated. He warned that the $50 billion Chinese AI chip market is now “effectively closed to U.S. industry.” As a result, Nvidia lowered its Q2 sales forecast. It now expects $45 billion in revenue, slightly below analysts’ forecast of $45.9 billion. Without the China setback, revenue guidance would have been $8 billion higher.

Despite this headwind, Nvidia’s financial base remains solid. Without the China charge, its gross margin would have been 71.3%, compared to the reported 61%. GAAP gross margin was 60.5%, and non-GAAP gross margin stood at 61.0%.

Read More:

- Bitcoin Hits All-Time High: Why the Cryptocurrency Is Surging Past $109K

- Cambodia Seeks China’s Financial Backing as Xi Visits Amid U.S. Tariff Tensions

- China’s April Exports Up 9.3%, Showing Resilience Against Tariffs

Nvidia’s data center division, known for its high margins, continues to anchor the company. Nearly half of its revenue in this segment came from cloud giants like Microsoft. Networking product sales totaled $5 billion, showing how critical interconnects have become for AI model deployment. Microsoft has already deployed tens of thousands of Nvidia’s Blackwell GPUs and plans to scale to hundreds of thousands, especially for its work with OpenAI.

Nvidia’s other business units also posted solid results. Gaming revenue rose 42% to $3.8 billion. Once Nvidia’s core segment, gaming now plays a secondary role—but still contributes to AI. Many gaming GPUs can handle AI tasks. Nvidia also continues to supply chips for consoles like the upcoming Nintendo Switch 2.

The automotive and robotics division saw 72% growth, reaching $567 million. This came from higher demand for autonomous driving chips and related software. The professional visualization unit also grew, with revenue up 19% year-over-year to $509 million.

Nvidia returned substantial capital to shareholders. It spent $14.1 billion on share repurchases and paid $244 million in dividends. A $0.01 per share dividend is set for July 3, 2025, for shareholders of record as of June 11. This reflects the post-June 2024 ten-for-one stock split.

Operating expenses also rose. GAAP expenses totaled $5.03 billion, up 7% from the prior quarter and 44% from a year ago. Non-GAAP expenses came in at $3.58 billion. Despite the increase, operating income remained strong—$21.64 billion on a GAAP basis and $23.28 billion non-GAAP.

Sequential declines in operating and net income occurred, but Nvidia attributed this to the China-related charge, not core business weakness. Excluding that charge, adjusted EPS held firm at $0.96, underscoring Nvidia’s financial strength.

Looking to Q2 of fiscal 2026, Nvidia forecasts $45 billion in revenue, plus or minus 2%. GAAP and non-GAAP gross margins are expected to be about 71.8% and 72%. Operating expenses should reach $5.7 billion (GAAP) and $4 billion (non-GAAP). The company expects $450 million in other income, excluding equity security gains or losses. The estimated tax rate is 16.5%, give or take 1%.

Nvidia also shared updates on its AI product roadmap. It announced full production of the Blackwell NVL72 AI supercomputer, designed for reasoning tasks. New architectures like Blackwell Ultra and NVIDIA Dynamo aim to boost AI inference even further.

The company also plans to expand manufacturing within the United States. This move supports the Biden administration’s CHIPS and Science Act. Nvidia aims to build AI supercomputers and infrastructure domestically, strengthening its supply chain and reducing exposure to global disruptions.

Nvidia’s reach now extends well beyond Silicon Valley. Huang described AI as “essential infrastructure,” comparable to electricity or the internet. Governments and businesses around the world increasingly agree. Nvidia’s technology powers both cloud platforms and edge devices, making it indispensable to the AI revolution.

The company’s hardware fuels major breakthroughs in fields like healthcare, education, automotive, and entertainment. Demand now comes not just from tech giants like Google, Amazon, and Microsoft—but also from traditional industries adopting AI.

Financial analysts at Goldman Sachs and Morgan Stanley remain bullish. They point to Nvidia’s first-mover edge and GPU leadership. Some have raised their price targets following the latest results.

Despite export limits and global tension, Nvidia continues to execute with precision. Its ability to pivot, innovate, and scale across markets makes it a key player in the global tech landscape.

As the AI era gains momentum, Nvidia’s Q1 results show it’s not just riding the wave—it’s shaping it. With expanding use cases, bold investments, and unmatched products, Nvidia stands as one of the decade’s most important tech companies.

![Xi Jinping meets Cambodia’s PM Hun Manet at Peace Palace, Phnom Penh – April 17, 2025 [AKP/Reuters]](https://theworldseye.com/wp-content/uploads/2025/04/2025-04-17T120007Z_1791565247_RC2NZDAP58BL_RTRMADP_3_CHINA-SOUTHEAST-ASIA-CAMBODIA-1744896414-390x220.jpg)